Investing in US Renewable Energy Stocks for 2026: 15% Return with Federal Incentives

Anúncios

Are you looking to capitalize on a burgeoning sector with significant growth potential?

Investing in Renewable Energy Stocks in the US for 2026: Targeting a 15% Return with Federal Incentives

offers a compelling opportunity for savvy investors. With the nation increasingly prioritizing sustainable solutions,

the landscape for clean energy is ripe for substantial financial gains, supported by a favorable regulatory environment.

Anúncios

The growing landscape of US renewable energy

The United States is undergoing a profound energy transition, shifting from traditional fossil fuels towards cleaner, more sustainable sources.

This monumental shift is not merely an environmental imperative but also a significant economic opportunity, attracting substantial investment and fostering innovation across various sectors.

Understanding the scope and drivers of this growth is crucial for any investor looking to participate.

Policy and market drivers

Several key factors are propelling the expansion of renewable energy in the US. Federal and state policies, technological advancements,

and increasing consumer demand for sustainable products all play pivotal roles. The Biden administration, for instance, has set ambitious goals for decarbonization,

which translate into strong policy support and financial incentives for renewable energy projects.

Anúncios

- Inflation Reduction Act (IRA): This landmark legislation provides billions in tax credits and incentives for renewable energy deployment, manufacturing, and related technologies.

- State-level mandates: Many states have Renewable Portfolio Standards (RPS) requiring utilities to generate a certain percentage of their electricity from renewable sources, creating a steady demand.

- Technological innovations: Continuous improvements in efficiency and cost reductions for solar panels, wind turbines, and battery storage are making renewable energy increasingly competitive.

Beyond government initiatives, the private sector is also heavily invested. Corporations are setting their own ambitious sustainability targets,

often opting for renewable energy solutions to power their operations. This corporate demand further bolsters the market, creating a diverse and robust ecosystem for renewable energy growth.

The convergence of these forces creates a powerful tailwind for companies operating in this space.

In conclusion, the US renewable energy landscape is characterized by dynamic growth, driven by a combination of supportive policies,

technological progress, and burgeoning demand from both public and private sectors. This fertile ground provides a strong foundation for investors seeking long-term value and significant returns.

Federal incentives shaping renewable investment for 2026

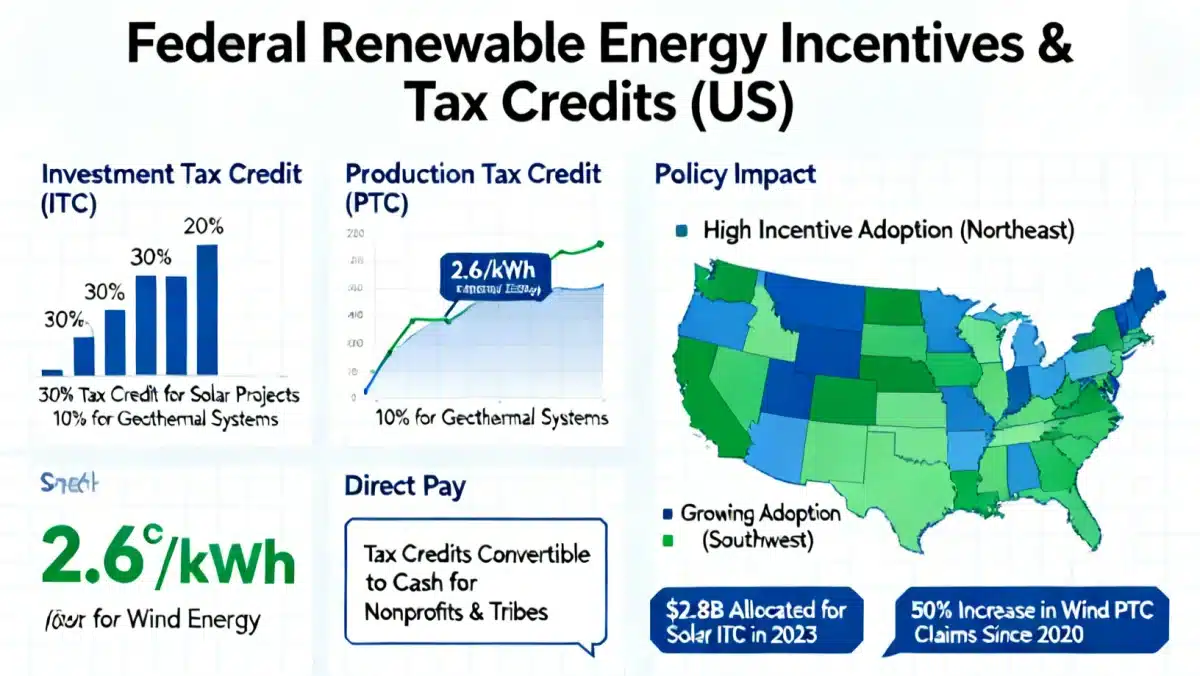

Federal incentives are not just buzzwords; they are tangible financial mechanisms designed to accelerate the adoption of renewable energy and significantly de-risk investments in the sector.

For investors targeting a 15% return by 2026, understanding these incentives is paramount, as they directly impact profitability and project viability.

These policies create a powerful economic advantage for renewable energy projects and companies.

The Inflation Reduction Act’s impact

The Inflation Reduction Act (IRA) stands as the most significant climate legislation in US history, offering a comprehensive suite of tax credits and grants.

These provisions are designed to lower the cost of clean energy technologies, making them more attractive for both developers and consumers. The IRA’s long-term structure provides predictability,

which is crucial for large-scale infrastructure investments.

- Investment Tax Credit (ITC): Extends and expands the ITC for solar, wind, and other clean energy technologies, offering up to 30% or more of project costs as a tax credit.

- Production Tax Credit (PTC): Provides incentives for electricity generated from renewable sources, ensuring a stable revenue stream for projects over their operational lifespan.

- Advanced Manufacturing Production Credit: Supports domestic manufacturing of clean energy components, fostering a robust supply chain within the US.

Beyond the IRA, other federal programs and grants continue to support renewable energy research, development, and deployment.

These incentives collectively reduce capital expenditure, enhance project economics, and attract private capital into the sector.

They are a clear signal of the government’s commitment to clean energy and provide a stable foundation for growth.

In essence, these federal incentives act as a powerful catalyst, making renewable energy projects more financially attractive and accelerating their deployment across the nation.

For investors, this translates into reduced risk and enhanced potential for achieving targeted returns within the specified timeframe.

Identifying promising renewable energy sectors and stocks

The renewable energy sector is diverse, encompassing various technologies and market segments.

To achieve a targeted 15% return by 2026, investors must strategically identify the most promising areas and the companies best positioned to capitalize on current trends and federal incentives.

Not all renewable energy segments offer the same growth trajectory or risk profile.

Key sub-sectors for investment

While solar and wind power remain dominant, emerging technologies and supporting infrastructure are also critical.

Diversifying across these sub-sectors can help mitigate risk and capture broader market upside.

Each segment has its unique drivers and potential for expansion.

- Solar energy (photovoltaic and concentrated solar power): Continued cost reductions and efficiency gains make solar a highly competitive power source. Companies involved in manufacturing, project development, and utility-scale installations are strong contenders.

- Wind energy (onshore and offshore): Offshore wind, in particular, is poised for significant growth in the US, supported by federal and state initiatives to develop large-scale projects.

- Energy storage (batteries and grid solutions): Essential for grid stability and integrating intermittent renewable sources, the energy storage market is expanding rapidly. Companies developing advanced battery technologies and grid management systems are crucial.

- Electric vehicle infrastructure: While not direct energy generation, EV charging infrastructure is a critical component of the broader clean energy transition, offering substantial growth potential.

When evaluating individual stocks, it’s vital to look beyond just the technology. Consider companies with strong balance sheets, proven management teams,

a clear competitive advantage, and a solid pipeline of projects. Companies with diversified revenue streams or those deeply integrated into the renewable energy supply chain may offer more resilience.

Ultimately, successful investment in renewable energy stocks for 2026 hinges on a thorough understanding of the various sub-sectors and careful selection of companies with robust fundamentals and strong growth prospects.

Focusing on these areas will enhance the likelihood of achieving ambitious return targets.

Risk assessment and mitigation strategies

While the potential for significant returns in renewable energy stocks is high, it is crucial to acknowledge and address inherent risks.

No investment is without its challenges, and the renewable sector, despite its growth, faces unique regulatory, technological, and market-related hurdles.

A proactive approach to risk management is essential for protecting capital and achieving targeted gains.

Understanding common investment risks

Several factors can impact the performance of renewable energy investments.

These risks range from policy changes to operational challenges, and investors must be aware of their potential effects.

- Policy uncertainty: While current federal incentives are strong, future policy shifts or changes in government priorities could impact the sector’s growth trajectory.

- Technological obsolescence: Rapid advancements in renewable energy technology mean that current solutions could be superseded, affecting the long-term value of some assets.

- Supply chain disruptions: Geopolitical events or natural disasters can disrupt the supply of critical components, leading to project delays and increased costs.

- Interest rate fluctuations: Renewable energy projects are often capital-intensive and sensitive to changes in interest rates, which can affect financing costs and project viability.

- Grid integration challenges: Integrating large amounts of intermittent renewable energy into existing grid infrastructure can present technical and operational complexities.

To mitigate these risks, investors should consider diversification across different renewable technologies and geographical regions within the US.

Investing in companies with strong R&D capabilities can also help counter technological obsolescence.

Furthermore, conducting thorough due diligence on a company’s financial health, management team, and project pipeline is vital.

Considering exchange-traded funds (ETFs) focused on renewable energy can also offer broader market exposure and inherent diversification.

By carefully assessing and implementing appropriate mitigation strategies, investors can navigate the complexities of the renewable energy market,

reducing potential downsides while still positioning themselves to capture the substantial upside potential by 2026.

Forecasting a 15% return: methodology and considerations

Targeting a 15% return on investment in US renewable energy stocks by 2026 is an ambitious yet achievable goal,

given the current market dynamics and robust governmental support.

However, this projection is based on several key assumptions and requires a clear methodology for assessment and ongoing monitoring.

Factors influencing return projections

Achieving a 15% return involves a confluence of factors, including market growth, company performance, and the consistent application of federal incentives.

Understanding these elements is crucial for realistic forecasting.

- Market growth rate: The overall expansion of the US renewable energy sector, driven by demand and policy, underpins the potential for stock appreciation. Analysts project sustained growth in solar, wind, and storage.

- Company-specific performance: The ability of individual companies to execute projects efficiently, manage costs, and innovate will directly impact their stock performance.

- Continued federal support: The stability and longevity of federal incentives, particularly the IRA, are critical for maintaining project profitability and investor confidence.

- Technological advancements: Further improvements in efficiency and reductions in the cost of renewable technologies can enhance profit margins and drive market adoption.

- Economic environment: Broader economic conditions, including inflation, interest rates, and GDP growth, will naturally influence market sentiment and investment flows.

Our methodology for forecasting a 15% return involves analyzing historical growth rates of the renewable energy sector,

evaluating the financial impact of current and projected federal incentives, and assessing the growth pipelines of leading companies.

We also consider expert consensus forecasts for renewable energy deployment and electricity demand.

While past performance is not indicative of future results, the fundamental drivers suggest strong continued momentum.

In conclusion, while a 15% return is a robust target, it is grounded in the strong fundamentals of the US renewable energy market,

supported by significant federal backing. Careful selection and continuous monitoring will be key to realizing this potential.

Long-term outlook beyond 2026 for renewable energy

While the focus on 2026 provides a concrete short-to-medium-term investment horizon, it is equally important to consider the long-term trajectory of the renewable energy sector in the US.

The trends and policies currently in place suggest that the growth will not abate post-2026 but rather accelerate, shaping the energy landscape for decades.

Sustainable growth drivers

The forces driving renewable energy adoption are fundamental and enduring, extending far beyond specific legislative cycles.

These drivers ensure continued expansion and innovation in the sector.

- Decarbonization goals: The global push for net-zero emissions will continue to necessitate a rapid transition to renewable energy. The US, as a major economy, is committed to these goals.

- Energy independence: Reducing reliance on volatile fossil fuel markets by leveraging domestic renewable resources enhances national energy security.

- Cost competitiveness: Renewable energy sources are increasingly the cheapest form of new electricity generation, making them economically preferable even without subsidies in many regions.

- Technological innovation: Ongoing research and development will continue to improve efficiency, reduce costs, and unlock new applications for renewable energy, such as green hydrogen.

- Consumer and corporate demand: Public and private entities are increasingly demanding clean energy, driving market growth irrespective of governmental policy shifts.

The infrastructure being built today, from new transmission lines to battery storage facilities, is laying the groundwork for a future energy system dominated by renewables.

Investments made now are not just for short-term gains but position investors to benefit from a multi-decade transformation.

The transition is irreversible, propelled by economic, environmental, and geopolitical imperatives.

Therefore, even after achieving 2026 targets, the long-term prospects for renewable energy stocks US remain exceptionally strong.

In summary, the long-term outlook for renewable energy in the US is robust and positive, driven by a combination of policy, technology, and market forces.

Investors who plant their stakes now are likely to reap significant rewards well beyond the initial 2026 target.

| Key Investment Area | Brief Description |

|---|---|

| Federal Incentives | IRA provides significant tax credits and grants, boosting project profitability and investor confidence. |

| Promising Sectors | Solar, wind (especially offshore), energy storage, and EV infrastructure show strong growth potential. | Risk Mitigation | Diversification, due diligence, and monitoring policy changes are crucial for managing investment risks. |

| Long-Term Outlook | Beyond 2026, decarbonization goals and cost competitiveness ensure sustained growth and opportunities. |

Frequently asked questions about renewable energy investments

The primary federal incentives include the Investment Tax Credit (ITC) and the Production Tax Credit (PTC), both significantly expanded and extended by the Inflation Reduction Act (IRA). These credits reduce project costs and provide stable revenue streams, making renewable energy investments more attractive and financially viable for developers and investors.

For investment by 2026, the most promising sectors include solar energy (both utility-scale and distributed), onshore and offshore wind power, and energy storage solutions like advanced batteries. Additionally, companies involved in electric vehicle charging infrastructure are poised for significant growth as EV adoption accelerates across the US.

Key risks include potential changes in federal or state policy, rapid technological obsolescence, disruptions in the global supply chain for components, and fluctuations in interest rates affecting project financing. Grid integration challenges and market competition also pose risks that investors should carefully evaluate before committing capital.

Targeting a 15% return requires careful selection of companies with strong fundamentals, diversified portfolios, and robust project pipelines. Investors should focus on sectors with high growth potential, leverage federal incentives, and employ diversification strategies to mitigate risk. Continuous market monitoring and adapting to new developments are also essential.

Beyond 2026, the long-term outlook for US renewable energy investments remains highly positive. Driven by ongoing decarbonization goals, increasing energy independence, continuous technological advancements, and growing cost competitiveness, the sector is expected to maintain its robust growth trajectory, offering sustained opportunities for investors well into the future.

Conclusion

Investing in Renewable Energy Stocks in the US for 2026: Targeting a 15% Return with Federal Incentives

presents a compelling and strategically sound opportunity within the current financial landscape.

The confluence of robust federal support, particularly through the Inflation Reduction Act,

rapid technological advancements, and increasing market demand creates a fertile environment for significant capital appreciation.

While risks are inherent in any investment, a thoughtful approach to sector selection, company due diligence, and risk mitigation can position investors favorably.

The long-term trajectory of the US renewable energy sector suggests that this growth is not a fleeting trend but a foundational shift, promising sustained value creation for years to come.