University fees debate: understanding the impact on students

Anúncios

The university fees debate explores the financial implications for students, highlighting budgeting strategies, financial aid options, and global perspectives on tuition to make higher education more accessible.

The university fees debate is more relevant than ever as students face rising costs. Have you considered how these fees impact access to education and opportunities? Let’s delve into the complexities of this issue.

Anúncios

The history of university fees

The history of university fees is a significant aspect of higher education that shapes students’ experiences. Understanding how these fees originated helps us grasp their current impact on students.

Early Development of Tuition Fees

In ancient times, educational institutions operated differently than today. Many were funded by religious organizations or private donations. Tuition fees began to take shape in the Middle Ages when universities in Europe started charging for education.

Anúncios

- Universities were established, like the University of Bologna in 1088.

- Students often paid fees to cover professors’ salaries.

- The concept of tuition became more formalized over time.

As society progressed, the need for a trained workforce increased, leading to more structured educational systems. By the 19th century, many institutions adopted tuition fees as a standard practice.

Changes in Tuition Fees Over Time

Throughout the 20th century, university fees evolved significantly. After World War II, many governments recognized the importance of higher education and began to subsidize costs to promote access.

- Scholarship programs emerged to assist underprivileged students.

- Loan systems and financial aid became common.

- The push for free education in some countries challenged traditional fee structures.

More recently, the rising cost of university education has sparked debates about accessibility and affordability. Countries are constantly reevaluating their approach to tuition, balancing funding needs with student access.

Understanding the history of university fees not only highlights past decisions but also encourages discussions about future educational funding reform. It opens the floor to questions about who should pay and how much, ensuring that education remains accessible for all.

Financial implications for students

The financial implications for students regarding university fees can be significant. These costs often dictate the choices students make about their education and future career paths.

Understanding Tuition Costs

Tuition fees can vary widely between institutions. This discrepancy can affect students’ decisions on where to apply and attend. It’s essential for students to research and understand the total cost of attendance, which includes not only tuition but also living expenses, books, and supplies.

- Public universities usually charge lower fees than private ones.

- Out-of-state students often face higher tuition rates.

- Community colleges offer more affordable options to complete general education requirements.

Financial aid options are available but can be complicated. Many students rely on scholarships, grants, and loans to cover their educational expenses. However, these financial aids can add another layer of complexity to a student’s financial situation.

Long-Term Financial Effects

The burden of university fees doesn’t end after graduation. Students often graduate with significant debt, which can take years to repay. This debt can affect their financial stability and choices long into the future. It can influence decisions like home ownership or starting a family.

- High levels of debt can limit career choices.

- Repayment plans can be confusing and overwhelming.

- Interest rates on student loans can increase overall costs significantly.

Understanding the financial implications of attending university is essential for students in making informed decisions. This knowledge helps them weigh the benefits of their degree against the costs they will incur.

Alternatives to traditional funding

Exploring alternatives to traditional funding is crucial as students seek ways to manage the high costs of university fees. Many individuals and organizations offer innovative solutions to help cover these expenses.

Crowdfunding Opportunities

Crowdfunding has emerged as a powerful resource for students. Through platforms like GoFundMe or Kickstarter, students can share their stories and raise funds directly from the public. This method allows friends and family, as well as strangers, to contribute to educational costs.

- Campaigns can showcase personal goals and achievements.

- This approach encourages community support and engagement.

- Students may connect with others who have similar aspirations.

In addition to crowdfunding, students can explore grants and scholarships from various organizations. Many non-profits and corporations offer financial support based on academic performance or specific fields of study.

Part-Time Work and Internships

Another popular alternative is to seek part-time work or educational internships related to their field. This option allows students to earn money while gaining valuable experience in their industry. Internships often come with stipends or credit, which helps minimize the financial burden.

- Part-time jobs can teach important skills and responsibility.

- Internships can lead to job offers after graduation.

- This approach also enhances networking opportunities with professionals.

In the evolving landscape of higher education, considering these funding alternatives is essential for students. With creativity and diligence, they can find ways to make university more affordable while still pursuing their dreams.

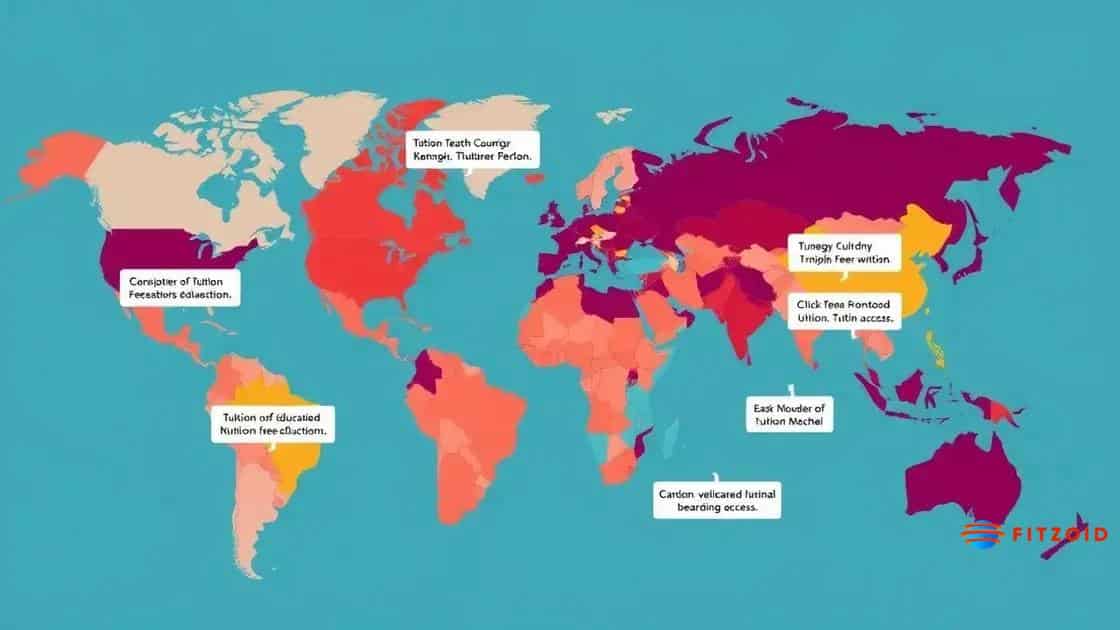

Global perspectives on tuition fees

The global perspectives on tuition fees highlight how different countries approach the cost of higher education. Understanding these variations can provide valuable insights for students and policymakers alike.

Tuition Fees Around the World

In some countries, such as Germany and Finland, public universities offer free or very low tuition for both local and international students. This approach aims to promote education and increase access. In contrast, countries like the United States often have higher tuition rates due to a reliance on private funding and state policies.

- In Germany, higher education is largely funded by the government.

- In the UK, students face substantial fees, often exceeding £9,000 per year.

- The Australian system features a unique model where students only pay back their loans once they reach a certain income level.

These examples demonstrate the range of policies designed to balance quality education with financial sustainability.

Impact of Tuition Policies on Access

Different tuition fee structures can significantly impact students’ ability to access higher education. Countries offering free education typically see higher enrollment rates among disadvantaged groups. On the other hand, high tuition fees can deter potential students, creating barriers based on socioeconomic status. For instance, in the U.S., student loan debt has become a major concern, affecting many graduates’ financial stability.

- Countries with low tuition often have more equitable access.

- High tuition can lead to significant debt burdens for graduates.

- Access to scholarships and grants can vary widely across regions.

As discussions around education funding continue globally, understanding these perspectives can inform policies that seek to make education accessible for all. By learning from different systems, we can better address the challenges faced by students everywhere.

Strategies for managing university costs

Managing university costs is essential for students aiming for financial stability during their education. Various strategies can help minimize expenses while maximizing learning opportunities.

Budgeting Effectively

One of the first steps in controlling costs is creating a budget. This practice helps students track their income and expenses. By knowing where money is going, students can make informed decisions about their spending.

- Identify fixed and variable expenses for better clarity.

- Set spending limits for entertainment and dining out.

- Adjust budget regularly to reflect changes in income or expenses.

Sticking to a budget can significantly reduce unnecessary spending, allowing students to save for tuition and other essential costs.

Utilizing Financial Aid

Applying for financial aid is another key strategy. Many students may not be aware of the variety of resources available. Scholarships, grants, and work-study programs can alleviate some financial burdens.

- Research local scholarships and apply early.

- Complete the FAFSA to identify federal and state aid options.

- Explore work-study opportunities related to field of study.

Financial aid can be a lifeline for students, helping them focus on their studies without the constant worry of financial strain.

Living Economically

Choosing where to live during university can impact costs significantly. On-campus housing might seem convenient but may not always be the most affordable option. Exploring shared accommodations or off-campus housing can bring down living expenses.

- Consider sharing an apartment with friends to split costs.

- Look for housing close to campus to reduce transportation expenses.

- Utilize public transportation options when available.

By implementing these strategies, students can take control of their finances, ensuring their focus remains on academic success rather than financial stress.

FAQ – Frequently Asked Questions about University Fees and Funding Strategies

What are some effective ways to manage university costs?

Budgeting effectively, applying for financial aid, exploring scholarships, and finding economical housing options can help manage university costs.

How can students benefit from financial aid?

Financial aid can significantly reduce the financial burden, allowing students to focus on their studies without worrying about excessive debt.

What role does budgeting play in student finances?

Budgeting helps students track their expenses and income, promoting wise spending habits and enabling them to save for essential costs.

Are there alternatives to traditional funding for education?

Yes, alternatives like crowdfunding, scholarships, and part-time jobs can provide additional financial support for students during their education.